The Impact of EU's Carbon Border Adjustment Mechanism on the Aluminum Industry

1. Introduction

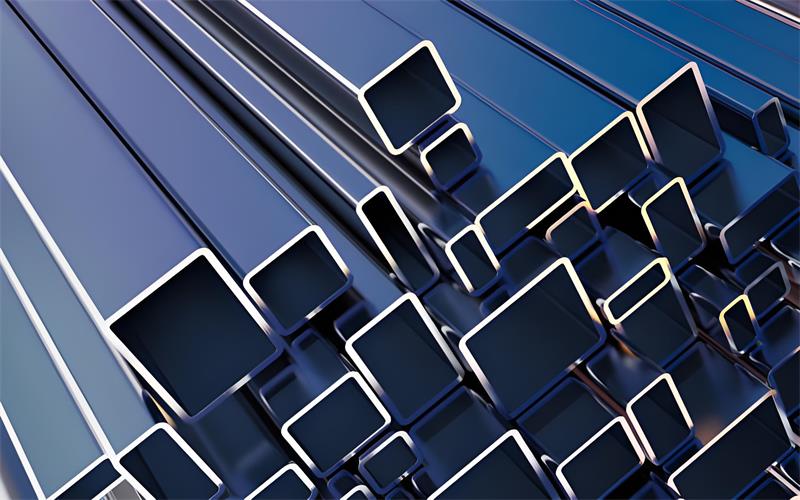

The European Union's Carbon Border Adjustment Mechanism (CBAM), set to take effect in 2026 for aluminum extrusion products, represents a pivotal shift in global trade dynamics. As the world's largest exporter of aluminum profiles and aluminium products, China faces unprecedented challenges in maintaining its competitiveness in the EU market. This blog explores how CBAM will reshape the industry landscape, the strategies Chinese enterprises must adopt to comply, and the long - term implications for global aluminum trade. Understanding these changes is crucial for companies like aluinno, which aim to navigate the evolving regulatory environment while driving sustainable growth.

2. Overview of CBAM

Policy Framework

CBAM requires importers to purchase certificates corresponding to the embedded carbon emissions in aluminum products. Starting in 2026, the mechanism will cover direct emissions from aluminum production, including electrolysis and refining processes. By 2030, indirect emissions from electricity consumption will also be included. The carbon price is linked to the EU Emissions Trading System (ETS), ensuring imported goods face equivalent costs to domestic products.

Policy Objectives

The primary goal of CBAM is to prevent "carbon leakage," where EU companies relocate carbon - intensive production to countries with lax environmental standards. By equalizing carbon costs, the EU aims to incentivize global emission reductions while protecting its domestic industries. CBAM also aligns with the EU's commitment to achieving carbon neutrality by 2050, sending a strong signal to other nations to adopt more ambitious climate policies.

3. Impact on Chinese Aluminum Exports

Cost Escalation

Chinese aluminum producers, heavily reliant on coal - fired electricity, face significantly higher costs under CBAM. The average carbon intensity of Chinese aluminum production is estimated to be 16 - 18 tons of CO₂ per ton of aluminum, compared to 4 - 6 tons in Europe. This disparity could result in carbon fees of up to $200 per ton of aluminum exported to the EU, eroding price competitiveness. For aluminum profiles, which account for a substantial portion of China's exports, the additional cost could make them less attractive to European buyers.

Market Share Risks

European importers may turn suppliers with lower carbon footprints, such as those in the Middle East or Russia, which use more natural gas or hydropower in production. Chinese enterprises could lose up to 30% of their EU market share if they fail to reduce emissions. This shift would not only impact export volumes but also threaten the livelihoods of millions employed in China's aluminum industry.

4. Competitiveness Challenges

Technology Gap

China's aluminum industry relies on outdated technologies that are energy - intensive and carbon - heavy. Transitioning to low - carbon alternatives, such as inert anode technology or hydrogen - based smelting, requires substantial R&D investment and time. Small and medium - sized enterprises (SMEs) may struggle to afford these upgrades, widening the gap between industry leaders and laggards.

Compliance Costs

Meeting CBAM requirements will involve comprehensive carbon accounting, auditing, and certification. Enterprises must invest in monitoring systems to track emissions across the supply chain, from bauxite mining to aluminum profile fabrication. These compliance costs, on top of emission reduction measures, will further strain profit margins.

5. Strategies for Mitigation

Clean Energy Transition

Shifting to renewable energy sources is critical. For example, aluinno could invest in solar or wind power plants to supply electricity to its smelters. Yunnan and Sichuan provinces, with abundant hydropower, offer viable locations for low - carbon aluminum production. By reducing reliance on coal - fired power, companies can significantly lower their carbon intensity.

Process Optimization

Improving energy efficiency in production processes can also reduce emissions. Technologies such as advanced electrolysis cells, waste heat recovery systems, and intelligent manufacturing solutions can cut energy consumption and associated carbon output. Recycling aluminum scrap, which requires only 5% of the energy needed for primary production, is another effective strategy.

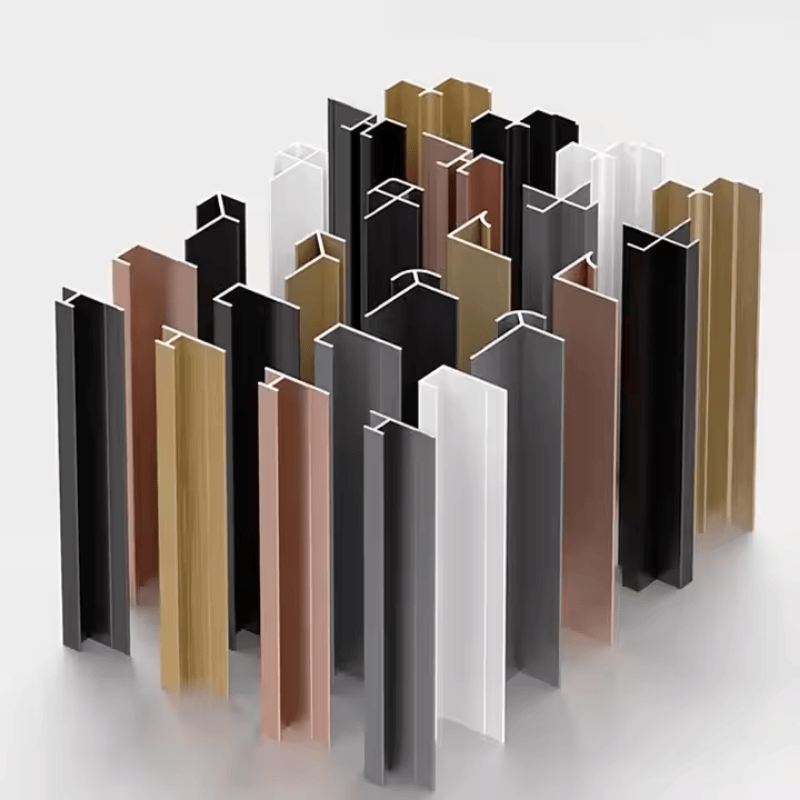

Product Innovation

Developing low - carbon aluminum profiles with certified environmental credentials can help Chinese enterprises retain market share. By highlighting the carbon footprint of their products, companies can appeal to environmentally conscious European buyers. Collaborations with research institutions and international partners can accelerate the development of such innovative products.

6. Industry Transformation

Structural Changes

CBAM will accelerate the consolidation of China's aluminum industry, as smaller, less efficient producers are forced out of the market. Larger enterprises like aluinno, with the resources to invest in low - carbon technologies, will gain a competitive edge. This shift towards a more concentrated industry could improve overall sustainability and global competitiveness.

Global Cooperation

Chinese enterprises can partner with EU counterparts to develop and implement low - carbon solutions. Joint ventures, technology transfer agreements, and knowledge sharing platforms can help bridge the technology gap and reduce compliance costs. International cooperation will also be essential in shaping global carbon standards and ensuring a level playing field for all exporters.

7. Conclusion

The EU's CBAM presents significant challenges for China's aluminum industry, particularly in terms of cost competitiveness and market access. However, it also offers opportunities for innovation and sustainable growth. By embracing clean energy, optimizing processes, and investing in product innovation, companies like aluinno can not only meet CBAM requirements but also position themselves as global leaders in low - carbon aluminum production. The transition will require collaboration between governments, industries, and international organizations, but the rewards of a greener, more competitive aluminum sector are well worth the effort.

En

En

Location:

Location: