China's Aluminum Exports in the Face of Trade Frictions: Strategies for Adjustment

In the global economic landscape, the aluminum industry holds a crucial position. China, as a major player in the global aluminum market, has long been a significant exporter of aluminum products. However, in recent years, the escalating trade frictions, especially between China and the United States, have cast a shadow over China's aluminum exports. This blog post aims to delve into the current situation and explore effective strategies for China's aluminum exports in the face of such challenges.

1. Impact of US - China Trade Frictions on China's Aluminum Exports

The trade frictions between the US and China have had a profound impact on China's aluminum exports. Since 2018, the US has imposed a series of tariffs on Chinese aluminum products. In 2024, the US further increased the aluminum product tariff to 25% and expanded the tariff list, covering almost all aluminum processed materials. In 2025, Trump signed an executive order to impose a 10% tariff on all Chinese imports, which may further rise.

These tariff hikes have directly led to a decline in the competitiveness of Chinese aluminum products in the US market. The cost of Chinese aluminum products in the US has increased significantly, causing a decrease in demand. For example, in 2018 - 2023, US imports of aluminum from China decreased by about 9.9%, and China's share in the US aluminum market declined. In the first quarter of 2024, China's exports of unwrought aluminum and aluminum products to the US were only 67,000 tons, accounting for 4.5% of the total exports. If the tariff rate on Chinese aluminum products in the US further increases to 35%, 48% or 60% in 2025, it is estimated that the impact on China's total aluminum product exports will be 132,000 tons, 162,000 tons and 210,000 tons respectively.

| Year | Share of Chinese Aluminum Products in the U.S. Market (%) |

|---|---|

| 2018 | ~10.2 |

| 2019 | ~8.5 |

| 2020 | ~6.8 |

| 2021 | ~5.5 |

| 2022 | ~4.7 |

| 2023 | ~4.3 |

| 2024 | 3.8 - 4.1 |

Moreover, the trade frictions have also increased the export costs of Chinese aluminum enterprises. The US's tariff hikes and China's cancellation of aluminum export tax rebates have forced enterprises to optimize in raw material procurement, production and processing, and logistics transportation to reduce costs. At the same time, enterprises also have to deal with price fluctuation risks. In order to maintain market share, enterprises have to absorb part of the tariff costs, compressing profit margins. In addition, the trade frictions have led to the obstruction of some raw material supply channels, and enterprises need to find alternative suppliers, increasing raw material procurement costs and supply risks.

In the highly competitive global aluminum market, Chinese aluminum export enterprises are facing greater pressure. The reduction in demand for Chinese aluminum in the US market has led to a decline in orders for some enterprises. At the same time, aluminum enterprises in other countries have taken the opportunity to seize the US market share, further intensifying the competition in the global aluminum market. Under the impact of trade frictions, some small and medium - sized enterprises with weak competitiveness may face operational difficulties or even be eliminated, while large enterprises will rely on their scale advantages, technological strength and brand influence to further consolidate their market positions through optimizing product structures and improving product quality, accelerating industry reshuffling.

2. Strategies for Adjusting China's Aluminum Exports under Trade Frictions

2.1. Expanding Emerging Markets

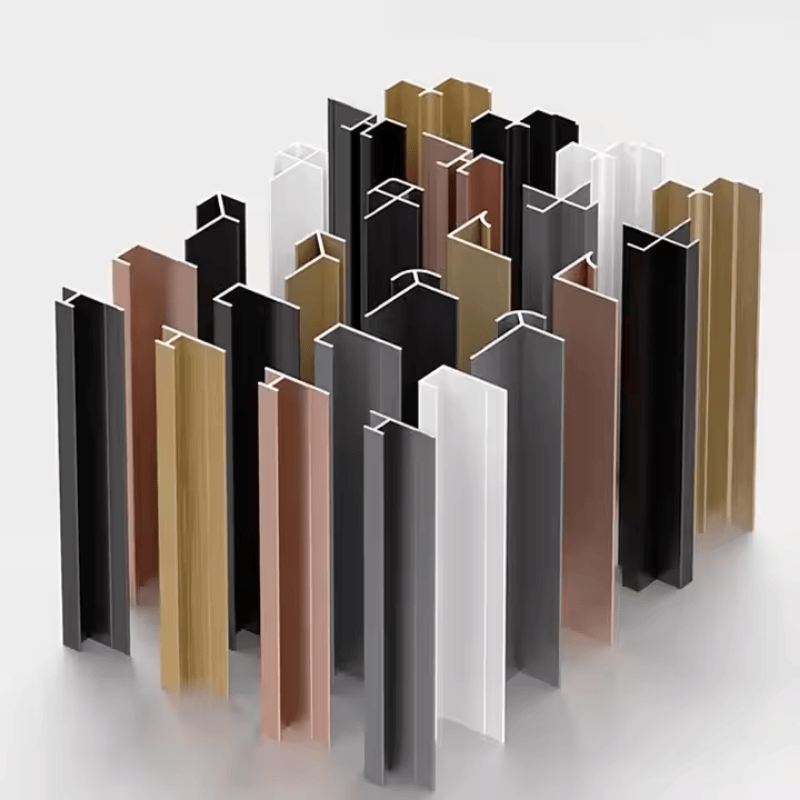

In the face of the shrinking US market, it is urgent for Chinese aluminum enterprises to expand emerging markets. Asia, with its large population and rapid economic development, especially countries in Southeast Asia, has a huge demand for aluminum products in infrastructure construction, real estate and manufacturing. For example, countries like Vietnam and Indonesia are in a stage of rapid urbanization, and the demand for aluminum profiles in building construction is increasing.

Europe also provides great opportunities. The European Union has strict environmental protection regulations, and aluminum, as a recyclable and lightweight material, has broad application prospects in the automotive, aerospace and other industries. China's aluminum enterprises can meet the high - quality and high - standard requirements of the European market by improving product quality and environmental protection performance.

South America and Africa are also emerging markets that cannot be ignored. South America has rich natural resources and is in the process of infrastructure improvement, which requires a large amount of aluminum products. Africa, with its vast land and huge development potential, has a growing demand for aluminum products in various fields such as construction, transportation and energy.

To expand these emerging markets, Chinese aluminum enterprises need to conduct in - depth market research to understand the specific needs and preferences of local customers. They should also establish local sales networks and after - sales service systems to improve customer satisfaction and brand awareness.

2.2. Enhancing Product Value - Added

One of the key ways to deal with trade frictions is to enhance the value - added of aluminum products. Chinese aluminum enterprises should increase investment in research and development to develop high - performance, high - tech aluminum products. For example, in the field of new energy vehicles, aluminum profiles with high strength, lightweight and corrosion - resistance properties are in great demand. By developing such products, enterprises can not only meet the needs of emerging industries but also improve their profit margins.

In addition, brand building is also crucial. A well - known brand can endow products with higher value. Chinese aluminum enterprises should strengthen brand promotion at home and abroad, improve brand image through participation in international exhibitions, cooperation with well - known enterprises, and high - quality product publicity. At the same time, improving after - sales service can also enhance customer loyalty. Providing timely technical support, solving product problems quickly, and collecting customer feedback can help enterprises continuously improve product quality and service levels.

2.3. Optimizing Export Structure

China should gradually shift from exporting low - end aluminum products to high - end products. In the past, a large number of China's exported aluminum products were low - value - added products such as ordinary aluminum profiles and aluminum ingots. Under the trade frictions, these products are more vulnerable to tariff impacts. Therefore, enterprises should accelerate the transformation and upgrading, develop high - end products such as aerospace - grade aluminum alloys, high - precision aluminum foils, etc.

Developing diversified product lines is also an important aspect of optimizing the export structure. In addition to traditional building and industrial applications, aluminum products can be extended to emerging fields such as 5G communication, new energy, and intelligent manufacturing. For example, in 5G base station construction, aluminum materials are widely used in heat dissipation components. By diversifying product lines, enterprises can reduce their dependence on a single market and product, and enhance their ability to resist risks.

3. Conclusion

In conclusion, the trade frictions between the US and China have brought severe challenges to China's aluminum exports, but also opportunities for transformation and upgrading. By expanding emerging markets, enhancing product value - added, and optimizing the export structure, Chinese aluminum enterprises can find new development paths. Companies like aluinno play an important role in this process. aluinno, with its professional R & D team, advanced production technology and high - quality product quality, can lead the way in implementing these strategies, continuously improve its competitiveness in the international market, and contribute to the stable development of China's aluminum export industry.

En

En

Location:

Location: